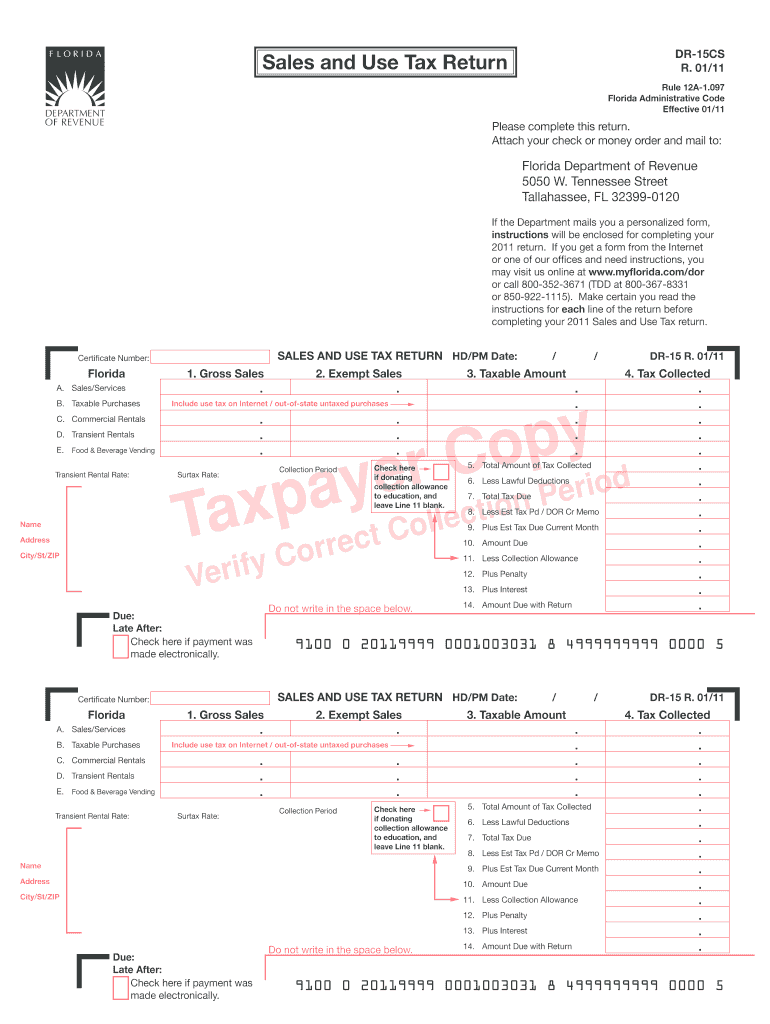

Who needs a form DR-15CS?

This is a sales and tax return for taxpayers in Florida. There are versions for 2011, 2012, 2015 and 2010 on this page. You can choose the reported period.

What is this return for?

It’s a regular report to the Florida Department of Revenue from individuals, business entities and organizations who made sales or provided services on the territory of the state. It can be filed monthly, quarterly, annually, or can be submitted as an amended return.

Is it accompanied by other forms?

Yes, it is in some cases. You need to attach checks or money orders to your return if you mail it to the Department of Revenue. If you impose a discretionary sales surtax on the reported sales, you need to add a completed copy of DR-15DSS to this form.

When is form DR-15CS due?

The payments are to be made by 5 p.m. of the business day before the 20th of the month after the reported period. For example, if it’s a return for sales made since September, 1st until September, 30th, the due date for paying applicable taxes is 5 p.m., October, 19th. The due date for a sales and use tax return is between the 1st and the 20th day of the month after the reported period.

How do I fill out this tax return?

There are two identical tables to report gross sales, exempt sales, taxable amount and tax collected from the sales, services, purchases, commercial and transient rentals, food & beverage vending for the reported period. On the second page, there are two identical tables for discretionary sales surtax. When you file a return and the FOR official adds it to the data, he will send you back one copy for your records.

Where do I send it?

Mail a completed copy to the following address:

Florida Department of Revenue

5050 W. Tennessee Street

Tallahassee, FL 32399-0120

You can also submit this return online at www.dor.myflorida.com.